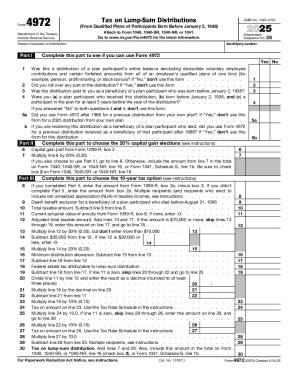

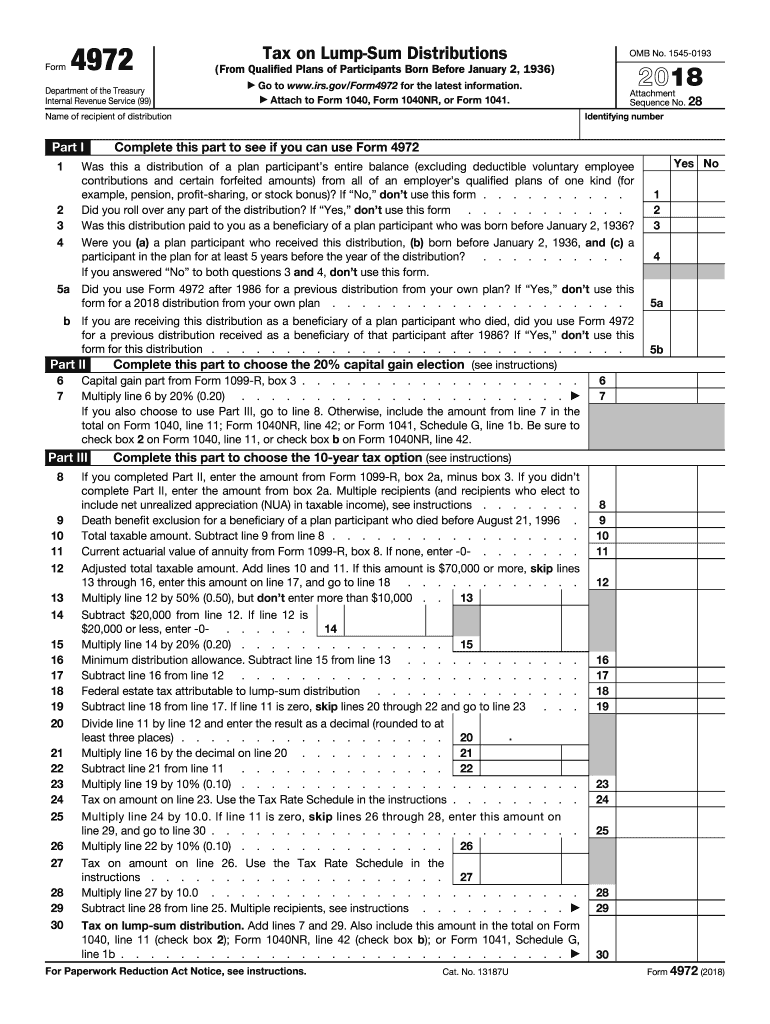

IRS 4972 2018 free printable template

Instructions and Help about IRS 4972

How to edit IRS 4972

How to fill out IRS 4972

About IRS 4 previous version

What is IRS 4972?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 4972

What steps should you take if you find an error after submitting the 2018 federal tax form?

If you discover an error after submitting your 2018 federal tax form, you should file an amended return using Form 1040X. Be sure to include the correct information and explain the changes made. Keep a copy of the amended form and any supporting documents for your records.

How can you verify the status of your 2018 federal tax form submission?

To verify the status of your 2018 federal tax form submission, visit the IRS website and use the 'Where's My Refund?' tool if you are expecting a refund. You can also contact the IRS directly for more specific inquiries about processing times or any issues with your submission.

What are common errors that taxpayers make on the 2018 federal tax form?

Common errors on the 2018 federal tax form include incorrect Social Security numbers, math errors, and forgetting to sign the form. Carefully reviewing your calculations and ensuring all personal information is accurate can help you avoid these pitfalls.

How should you respond to a notice or letter from the IRS regarding your 2018 federal tax form?

When responding to an IRS notice regarding your 2018 federal tax form, carefully read the correspondence for specific instructions. Compile any necessary documentation and respond by the deadline provided in the notice to ensure compliance and avoid potential penalties.

What privacy measures should you consider when filing your 2018 federal tax form electronically?

When filing your 2018 federal tax form electronically, ensure you are using secure internet connections and reputable software. Be cautious about sharing personal information and use e-signature options provided by credible tax preparation services to enhance data security.

See what our users say